Property depreciation formula

Value of building only 1 million. The cost is listed in cell C2 50000.

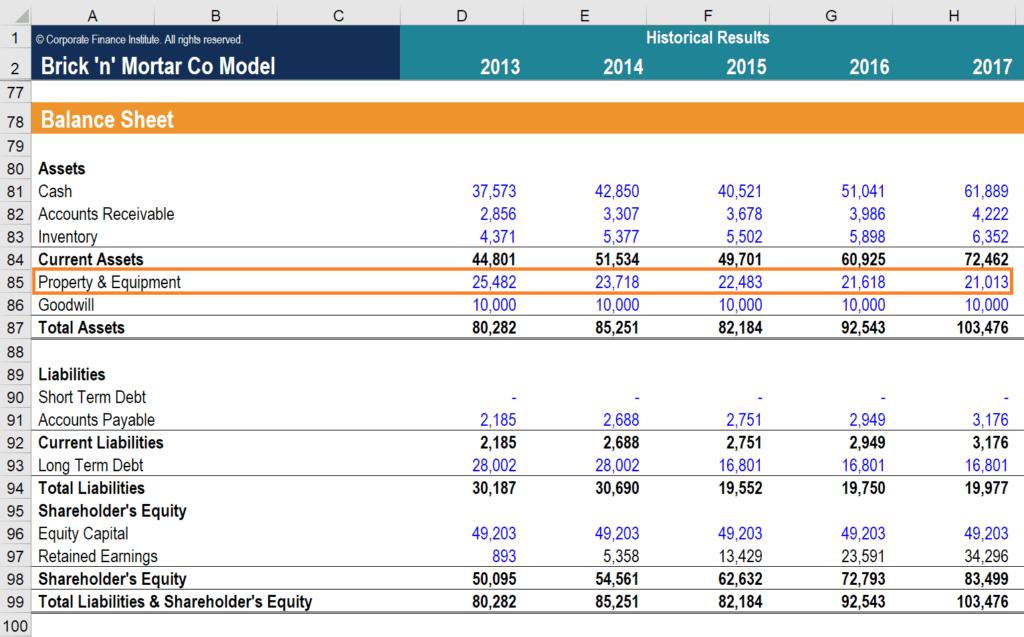

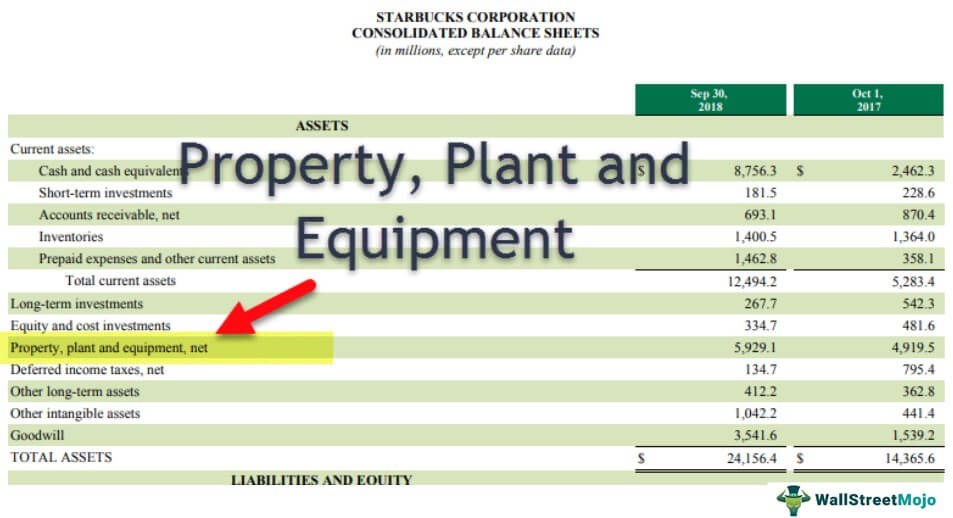

Pp E Property Plant Equipment Overview Formula Examples

Non-ACRS Rules Introduces Basic Concepts of Depreciation.

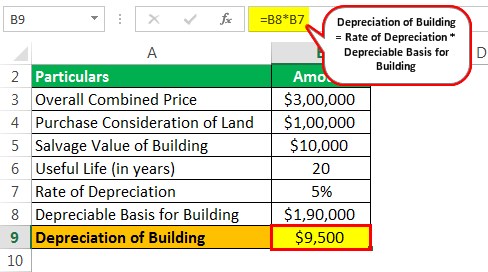

. The appreciation formula is. We need to define the cost salvage and life arguments for the SLN function. Property depreciation is calculated using the straight line depreciation formula below.

Final Year Depreciation - The depreciation amount taken in the final year. Amount of depreciation expenses that you can claim per year. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. The remaining life is simply the remaining life of the asset. Year 1 Depreciation Amount Beginning Asset Book Value x 2 x 1 Recovery Period Year 2 Depreciation Amount Beginning Asset Book Value - Year 1 Depreciation Amount x 2 x 1 Recovery Period.

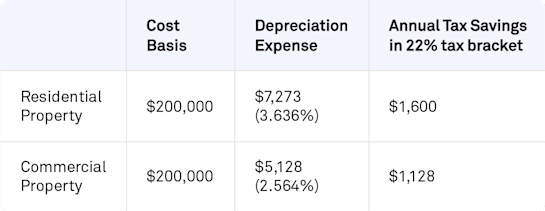

Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along. Total Depreciation - The total amount of depreciation based upon the difference between the depreciable asset value and the salvage value. Commercial real estate depreciation acts as a tax shelter by reducing the taxable income of investors.

Salvage is listed in cell C3 10000. After accounting for income and expenses involved with the property Mark can deduct this amount to lower the taxable income. In our example Marks asset was ready for service in January and would depreciate by 4672 each year.

And life for this formula is the life in periods of time and is listed in cell C4 in years 5. Heres a quick example of how real estate depreciation for commercial property works using the straight-line depreciation method. For example at the beginning of the year the asset has a remaining life of 8 years.

If a certain property that cost 180000 can be depreciated using a tax life of 275 years you would divide 180000 by 275 to yield a straight-line equal amount of 6545 in depreciation each year. The depreciation amount equates to 3636 of the adjusted basis depreciated each year. Request A Demo Today.

Amount paid when you bought. Calculate the depreciation for a rental property or real estate using the straight line method and mid-month convention as required by the IRS for rental property and real property. See it In Action.

How to Calculate Rental Property Depreciation. Appreciation Rate Current Value - Original Value Original Value. The straight line calculation steps are.

369000 property cost basis 275 years 1341818 annual depreciation expense. Determine the cost of the asset. Depreciation Base Cost Salvage value Depreciation Base 25000 0 25000 2.

This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. Thats your annual depreciation deduction and you didnt spend any extra dimes on costs to get it. The double-declining balance method depreciation formula is below.

Reduce Risk Drive Efficiency. Annual Depreciation Purchase Price - Land Value Useful Life Span in years Annual Depreciation. Annual depreciation deduction 1 million 39 years 25641.

Divide the sum of step 2 by the number arrived at in step 3 to get. To know how to calculate appreciation one will need to know the original value of the property. Determine the useful life of the asset.

The depreciation base is constant throughout the years and is calculated as follows. How to Calculate Straight Line Depreciation.

Like Kind Exchanges Of Real Property Journal Of Accountancy

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Property Plant And Equipment Pp E Formula Calculations Examples

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Of Building Definition Examples How To Calculate

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Rate Formula Examples How To Calculate

Understanding Rental Property Depreciation 2022 Bungalow

Depreciation Schedule Template Examples Geneevarojr

Property Plant And Equipment Schedule Template Excel Schedule Template Finance Career Financial Analysis

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Loan Repayment Schedule Investing Investment Property

Bonus Depreciation Calculator In 2022 Savings Calculator Bonus Real Estate

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet